Guest blog by Julian Richardson, CEO of Parhelion Underwriting Ltd.

All that glitters is not gold!

The train has left the station and the California carbon market is now well on its way to its first birthday, and that in itself is worth celebrating for a program whose arrival was something of a challenging pregnancy and difficult birth. Nonetheless, this delay has given the ARB and other stakeholders the opportunity to benefit from the experiences and learn from the mistakes of other programs that started earlier – in particular the Clean Development Mechanism (CDM) and the European Emissions Trading Scheme (EU ETS).

One important lesson learned from those programs was the importance of being able to challenge and, indeed, revoke any offsets that were not of sufficient environmental robustness and integrity. This integrity is crucial for any trading mechanism allowing offsets for compliance use. Without it, public and commercial trust is lost and the program will fail.

To achieve this integrity, the ARB has included within its regulations the opportunity to ‘invalidate’ offset credits that should not have been issued – also known as ‘buyer liability.’ Whilst ensuring the integrity of the program must be paramount, it does come at a cost to program participants. In this instance, the cost of including ‘invalidation’ provisions is that on one hand stakeholders are being encouraged to create and invest in an asset (offset credits), but on the other hand that asset is un-certain.

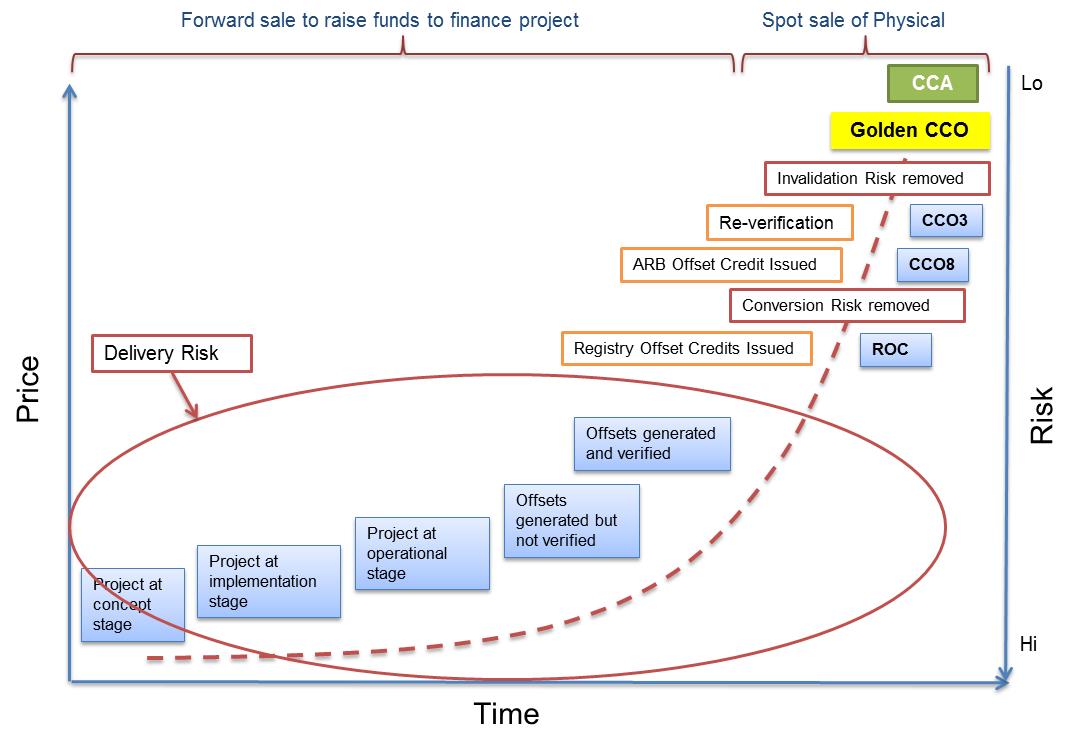

In the market, this has led to the development of a range of different grades of offset assets that can be bought and sold. The market has adopted the term ‘CCO’ to refer to California Carbon Offset. More specifically we hear about ‘CCO8s’ and ‘CCO3s’ and ‘Golden CCOs.’ But what exactly are these different grades and what does the price difference reflect?

Well, as is normal in any commodity market, the price difference reflects different risk profiles. The ‘3’ and ‘8’ refers to the length of ‘invalidation’ risk associated with a particular offset. Offsets that have been verified once have a liability tail of 8 years during which they may be invalidated by the ARB. This tail may be reduced to 3 years by having a second verification done by a different approved verifier. Simple!

What is less clear, however, is what is meant by a ‘Golden CCO.’ If you ask 5 people what they understand the term to mean you get 7 different answers. Equally the term ‘CCO’ itself is only a market expression and not defined anywhere in the regulations – but we’ll ignore that for the moment. Critically the issue seems to be whether ‘Delivery Risk’ is part of making CCOs Golden.

Like the ARB, Parhelion has had the benefit of learning from other carbon markets. The first product Parhelion developed was indeed a ‘Delivery Wrap’ for CDM credits. Strictly speaking ‘delivery’ is not actually a risk; it is a consequence. It is important to focus on actual real risks that lead to non-delivery which are many and varied. They include but are not limited to:

- Regulatory risk

- Credit risk

- Physical risk

- Operational risk

- Technology risk

Each of the above risks can themselves be disaggregated. Parhelion identified over 70 individual risks that could lead to non-delivery of CERs. A similar set of risks will apply to the generation of offsets for the California market.

How ‘Delivery Risk’ applies to California offsets will depend on what is actually being sold. If a project developer is seeking to forward sell a future stream of offsets in order to raise finance for the project costs then Delivery Risk will constitute a significant proportion of any risk discount applied. The size of this delivery risk will also vary significantly from project to project and counter party to counter party.

If, however, the project developer has sufficient resources to develop the project to completion before selling any offsets, then they can sell physical offsets, be they ROCs / CRTs or ARBOCs. At this point Delivery Risk has been removed.

The only remaining risks are ‘Conversion Risk’ and ‘Invalidation Risk.’ Conversion Risk relates to whether a Registry Offset Credit (ROC) will be converted into an ARBOC. In view of the important QA/QC role played by the registries, such as the Climate Action Reserve, this risk is perceived as small, and as more ROCs are converted, I believe this risk will become insignificant.

This leaves ‘Invalidation Risk.’ Whilst Invalidation Risk is not in my view a large risk, it is a very real risk. The ARB has effectively dealt itself a ‘get out of jail free’ card should there be any questions over the robustness and integrity of the offset program. Therefore irrespective of the excellent work being done by project developers to implement good quality projects; and by verifiers to ensure accurate verification of offsets; and by CAR to implement QA/QC controls to ensure only fully compliant offsets are generated and issued at the registry level – the risk remains. Mistakes do happen and there have already been instances where registry-issued offsets have effectively been invalidated.

The figure below illustrates how offset price and risk change over project development time.

Since ‘Delivery Risk’ can be so different and only applies to forward contracts, it is not helpful to include it in the definition of ‘Golden CCOs.’ That’s not to say Delivery Risk is not relevant, it is. More importantly, however, Delivery Risk is extremely hard to define and extremely diverse. Therefore it is appropriate to define ‘Golden CCOs’ as issued offsets with no invalidation risk.

The question then remains: how do you deal with ‘invalidation risk’? There are three options for this. The first option is for the risk to remain with the seller. In this case, the seller will agree to indemnify the offset owner in the event of any invalidation. The problem here is that many offset project developers are not credit worthy counter parties and these promises are only as good as the credit rating behind them. Buyers seeking to impose this liability on sellers may consider requiring the seller to hold insurance or demonstrate satisfactory creditworthiness.

The second option is then for the buyer of the offset to retain the risk. This decision will be down to the risk appetite of the buyer. However, if the buyer is willing to take this risk they will pay a lower price to the offset project developer – not an attractive option for the developer who should be keen to maximise the price they can achieve for their assets.

The third option is, therefore, to transfer the risk to a third party with a demonstrable ability to pay and an established reputation for a willingness to pay in the event of a loss. With the support of CAR, Parhelion has developed such a solution. There is, of course, a price associated with this but that price is well within the market spread between CCO3s and Golden CCOs.

To conclude, I think that trying to include ‘Delivery Risk’ within a broad generic definition such as a Golden CCO is a distraction. As Aristotle said “It is the mark of an educated mind to rest satisfied with the degree of precision which the nature of the subject admits and not to seek exactness where only an approximation is possible.”

© Parhelion Underwriting Ltd. 2013

About Parhelion

Parhelion has been the pioneer and recognized leader in the field of non-traditional insurance and risk finance solutions for the clean energy and climate finance sectors. This has included the successful development of innovative insurance products for the carbon trading, renewable energy and clean energy markets. Parhelion’s products are supported by leading Lloyd’s of London, International and Bermudan re/insurers. Parhelion provides advisory services to policy makers, multi-lateral and international financial institutions; investors; trader and project developers.

1 Comment

Can add to conversion risk – federal and international programs. While a federal cap and trade program may not be in our immediate future, it is within the lifespan of offset futures. And while the risk of a federal or international program not accepting CAR offsets, this conversion risk is not zero. Worth adding some discussion about preemption of the California program…given the longstanding goal of the program to be the more efficient federal and international programs.