Do you have any questions about carbon offsets or carbon markets? Our expert staff want to address myths, misunderstandings, and muddled impressions with facts and lessons learned from over 20+ years of carbon offset and market experience. Submit your questions to [email protected] and we’ll answer in our monthly newsletter and on our website.

February 5, 2024

Hi – thank you for your informational newsletter. Can you explain how the cash flows work for typical forestry offsets, eg it looks like most of the offsets are typically issued in year one, with some minimum number coming in the following say 1 to 5 years. But the forest protocol requires 100 years of annual monitoring? Can offsets be issued again after that first issuance? Trying to understand revenue and liability matching? – Paige

Hi Paige, forests are unique in the role they play mitigating atmospheric carbon, because they provide two critical benefits, serving as both carbon sinks and as pools for new sequestration. Forestry projects can be rewarded for these distinct benefits through a two-pronged crediting approach that recognizes the dual services performed by forests.

First, projects may be issued credits for avoiding potential losses in forest carbon that may be caused by harvesting that removes more carbon than is otherwise being sequestered in the same forested area, degradation that leads to declining stocks, or even conversion to a land use type with lower carbon stocking. Under the Reserve’s U.S. Forest Protocol, projects based on the improved forest management or avoided conversion project types can be issued credits in recognition of the positive difference between the initial project-level carbon stocks and the baseline, which represents the anticipated long-term average carbon stocks in the absence of the project. The baseline is based on both legal and financial considerations, as well as considerations for how similar forests within the same geographic area are managed. By crediting landowners at the start of the project for the difference between their project stocks and the baseline, projects are rewarded for past management practices that have yielded greater carbon storage than is typical among neighboring properties and for their long-term commitment to maintaining (or increasing) the amount of carbon they’re storing.

Second, projects are also issued credit throughout the remainder of the crediting period based on new annual growth—i.e., the new sequestration benefits—after taking into consideration any losses in carbon stocks from the forest, including as a result of timber harvests and natural disturbances. Not only is this the case for improved forest management and avoided conversion project types under the US Forest Protocol, but new sequestration benefits are also the only basis for crediting under the reforestation projects under the US Forest Protocol as well as all project registering under the Reserve’s Mexico, Guatemala, and Panama Forest Protocols.

In terms of cash flow, for forestry projects for which avoided carbon losses are recognized, the initial issuance can be significant—as much as an order of magnitude higher than the typical amount of credits that are likely to be issued for ongoing sequestration benefits over the course of the project. The amount of credits associated with the initial issuance, however, is dependent on a number of factors, including the condition of the forest on the project area and the condition of the broader forested landscape in which the project lies. Nevertheless, all projects—whether credited for avoided losses or not—will continue to be issued credits over time commensurate with how much carbon stocks increase from year to year. The rate of credits issued each year will depend on the forest’s overall composition and growing conditions and how much carbon is lost via timber harvests or other disturbances. Generally speaking, many projects are likely to have more credits issued in total from new sequestration benefits over a 20-year span of time than were issued initially in recognition of avoided carbon losses.

In any event, all projects are likely to reach a point in time where new credit issuances have slowed or ceased but project expenses continue by way of monitoring, reporting, and verifying. Landowners can plan for this in several ways, including setting up an endowment based on initial credit sales to fund future expenses or leveraging alternative revenue streams that are compatible with the carbon project, such as markets for timber or non-timber forest products.

August 31, 2023

What national and/or international regulatory body is verifying carbon offset claims? Why should the public believe these claims? – Linda

Hi Linda,

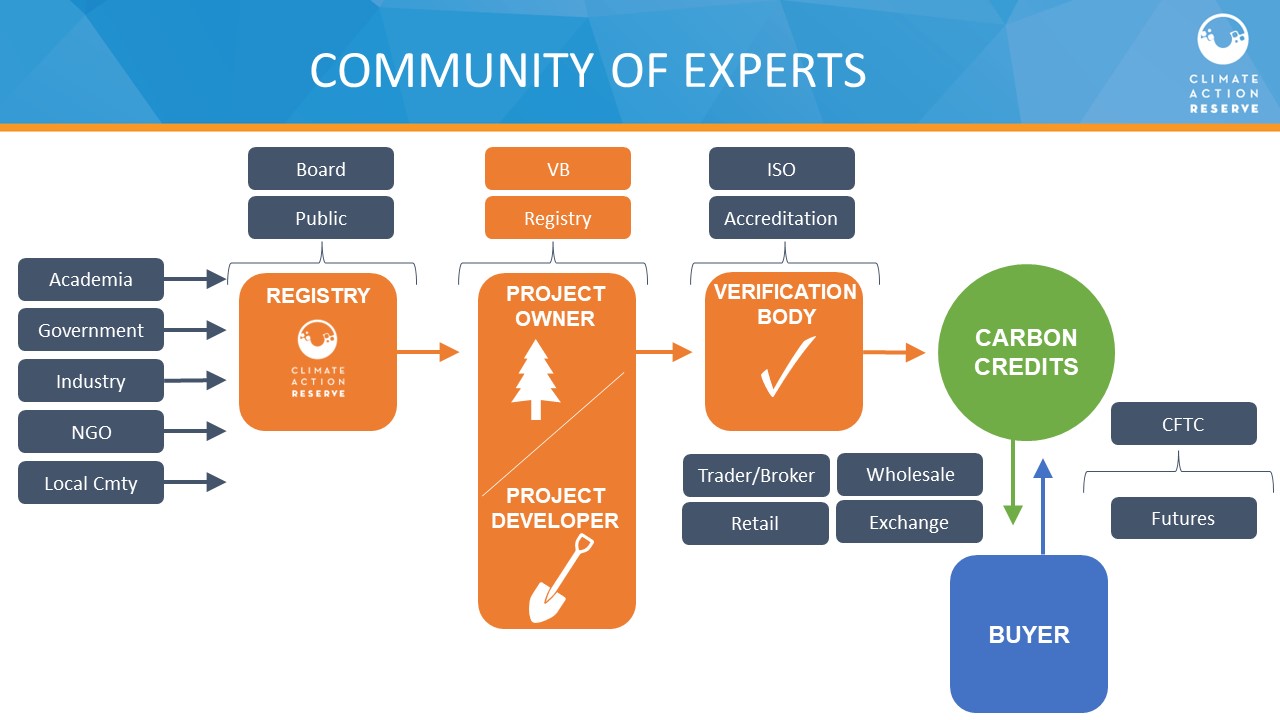

Thanks for your question! There is a community of experts involved in ensuring the verity of carbon offset claims.

To set the stage regarding verifying of claims, here’s some information on national and international agencies involved in the credit issuance process:

- As a project registry that develops protocols for global voluntary carbon markets, we employ a multi-stakeholder workgroup process that often involves federal agencies for input, datasets, maps, reports, models, and more. For example, the U.S. Forest Service serves on our Biochar Protocol workgroup and the Ministry of the Environment of Panama (MiAmbiente) serves on our Panama Forest Protocol workgroup.

- Projects developed under our protocols must undergo independent third-party verification by an accredited verification body. The International Organization for Standardization (ISO) develops international standards such as ISO 14064-2, which provides guidance at the project level for the quantification of GHG emissions reductions or removal enhancements, and ISO 14064-3, which provides guidance for verification of reports developed using 14064-2 and other project-level GHG quantification. Accreditation bodies, such as the American National Standards Institute, provides accreditation to verification bodies to ISO standards. Verification bodies can only perform verifications of carbon projects if they have accreditation to ISO standards.

There are two key international efforts that aim to provide integrity standards for offsets:

- Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA): CORSIA is a mandatory carbon credit scheme for international airplane operators. To ensure the environmental integrity of carbon offsets used in CORSIA, the ICAO Council approves eligible credits that can be used for compliance. The criteria is informed by a recommendation from the Technical Advisory Body and guided by environmental criteria to guarantee that emissions units deliver the required GHG reductions. Key criteria include: additionality, permanence, no leakage (unintended increases in emissions elsewhere), baseline must be determined to represent what would have happened if the project had not been implemented, accurate measurements, valid protocols, auditing, tracking of credits, avoid double counting, environmental and social safeguards.

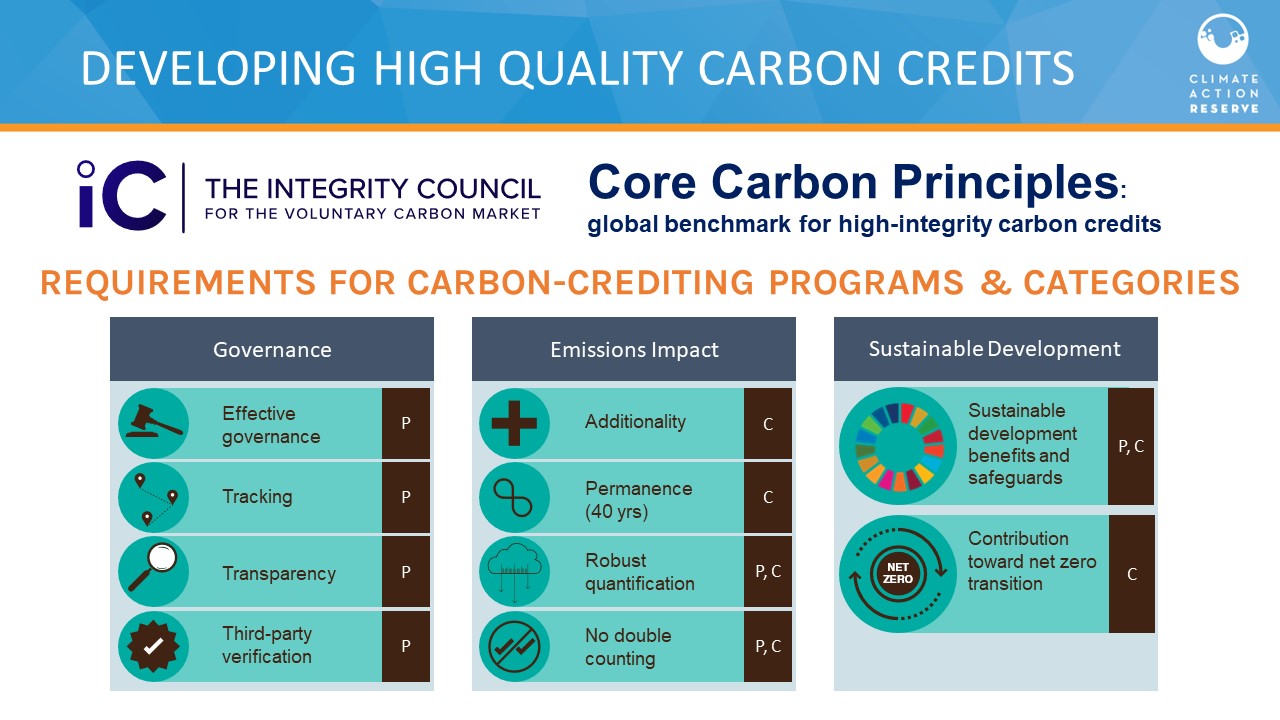

- Integrity Council for the Voluntary Carbon Market (ICVCM): The ICVCM Core Carbon Principles (CCP) establishes thresholds for high-quality credits with rules for carbon-crediting programs and categories to earn the CCP label, ensuring a high level of integrity in carbon credit claims and confidence in the carbon market. In order for credits to meet ICVCM criteria, the carbon-crediting program (registry) and carbon credit categories (protocols) must meet CCP standards:

International efforts that provide guidance to companies on offset use include:

- Science-Based Targets Initiative (SBTi): The SBTi isn’t necessarily involved in ensuring the verity of carbon offset claims, but provides guidance to companies on setting their GHG reduction targets – how much and how quickly a company needs to reduce emissions to be in alignment with Paris Agreement reduction goals based on sector and company. SBTi independently assesses and approves companies’ targets in line with its strict criteria and provides guidance on how to incorporate offsets into company goals, recommending the use of offsets to address company Scope 1-3 emission profiles, and requiring that a company offset residual emissions to reach long-term net-zero goals.

- Voluntary Carbon Markets Integrity Initiative (VCMI): VCMI developed its Claims Code of Practice to serve as a rulebook for companies on credible use of high-quality carbon credits on the path to net zero. Companies that want to use carbon credits must (1) meet foundational criteria, including transparent reporting of emissions, setting near-term SBT and net-zero by 2050, demonstrate it’s on track to near-term GHG target, and support the Paris Agreement; (2) select a VCMI claim to make: Silver – offset 20-60% of remaining emissions, Gold – offset 60-<100%, or Platinum – 100%+; (3) meet carbon credit use and quality thresholds through CORSIA or ICVCM, and disclose carbon credit info; and (4) validate carbon credit use to VCMI’s Monitoring, Reporting & Assurance framework, which involves third-party validation of compliance with foundational criteria and claim requirements.

Each credit issued by the Reserve has the knowledge and input of a community of experts, including academia, government, industry, NGOs, local communities, and even members of the public, behind it, which provides strong credibility for public trust in our carbon credit claims. A key tenet of GHG registries is their transparency. Reserve protocols, processes, and project documents are publicly available for review. Members of the public can review the protocol development details of any of our protocols, including workgroup members, workgroup meeting recordings and slidedecks, public comments and responses, and Board minutes when considering adoption. Project documents and verification reports are posted online for public review. Members of the public are part of the process and we hope they have confidence in the credits that the carbon community has achieved together.